European rental confidence takes a dip

The ERA/IRN RentalTracker for the second quarter of 2023 indicates a softening of business sentiment across multiple measures, although there is no collapse in confidence. IRN’s Murray Pollok reports.

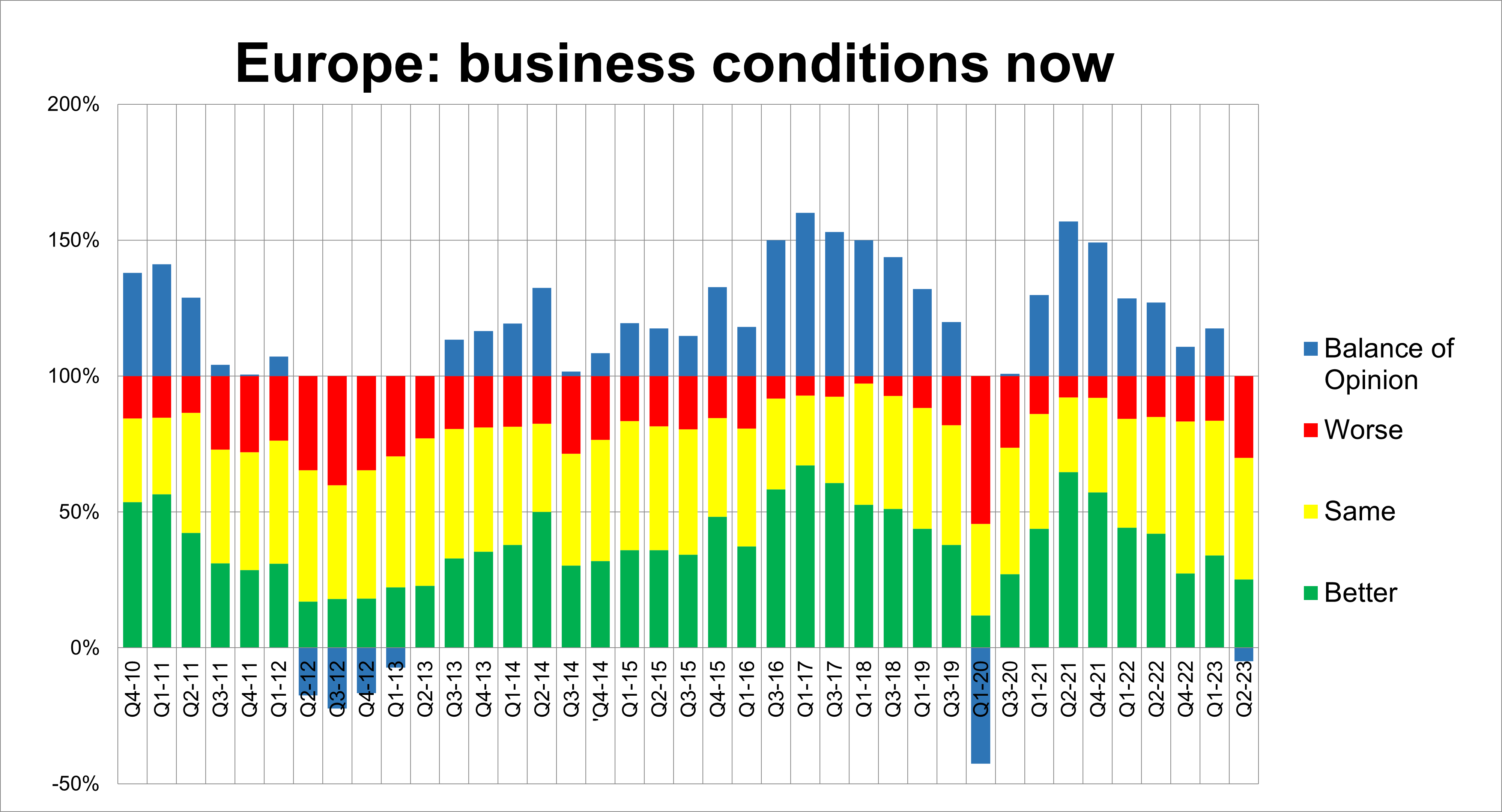

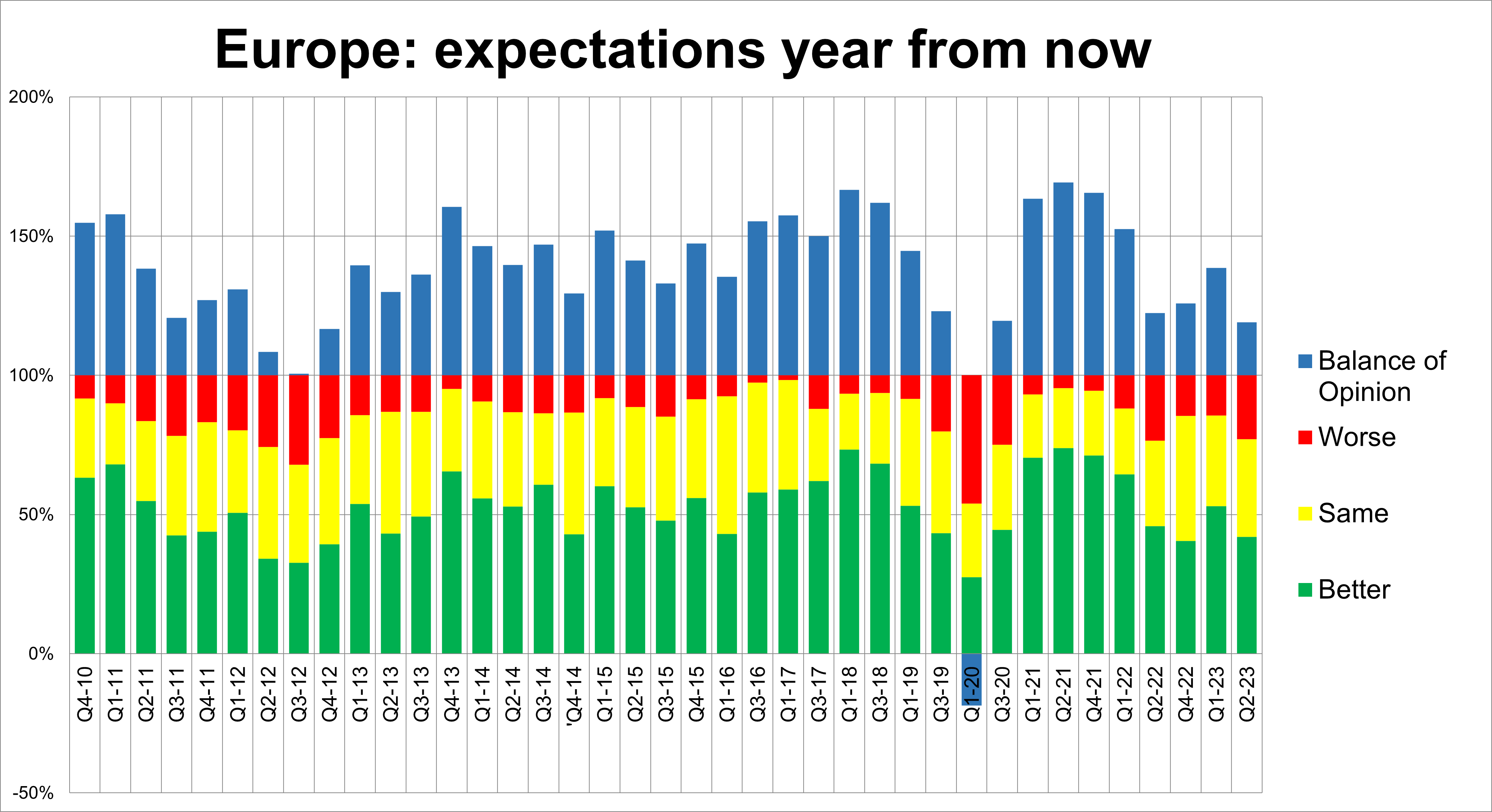

In the Q1 RentalTracker we talked about a ‘holding pattern’, with Europe’s rental industry seeming to be unsure about whether business conditions were improving or worsening. The Q2 survey – undertaken at the end of June – shows clearly that business conditions are deteriorating, although not dramatically, and with less positivity for the future than there was even three months ago.

More than 125 companies participated in the survey – the highest number for two years – and there was a better than usual response from companies in the UK and France, which will have had an impact on the overall findings, because companies in these countries tend to be less positive, currently.

By almost every measure, business sentiment has decreased. Asked about current business conditions at the end of June, there was a negative balance of opinion – more people expressed a downbeat view than a positive one – for the first time since the first quarter of 2020 (no need to remind you of what was happening then).

The negative balance is just -5%, but extends a steadily downward trend that began at the end of 2021.

Business activity levels in the second quarter were better year-on-year for many respondents, with a +22% balance of opinion. However, that compares to consistent +40% balances for the past two years. Growth in activity levels continues, but at a slower rate.

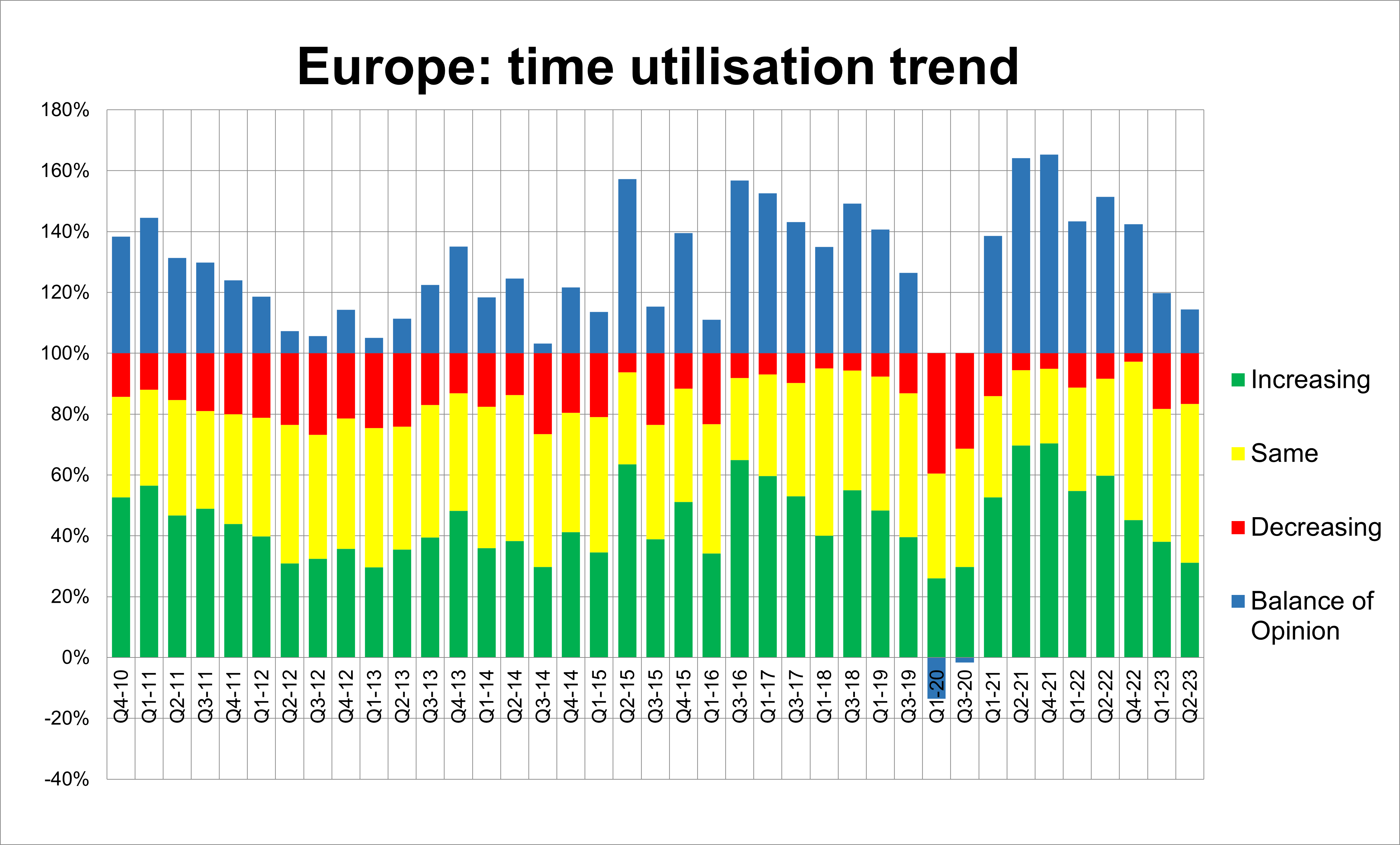

Utilisation falters

When it comes to time utilisation, there is still a positive balance of opinion on whether utilisation in increasing, stable or decreasing, with a balance of +14%. Just less than a third of respondents were reporting improving utilisation, but almost 70% were seeing stable (52%) or declining (17%) equipment usage.

That is not a bad position to be in as an industry, even if sentiment has been much more positive in the past two years.

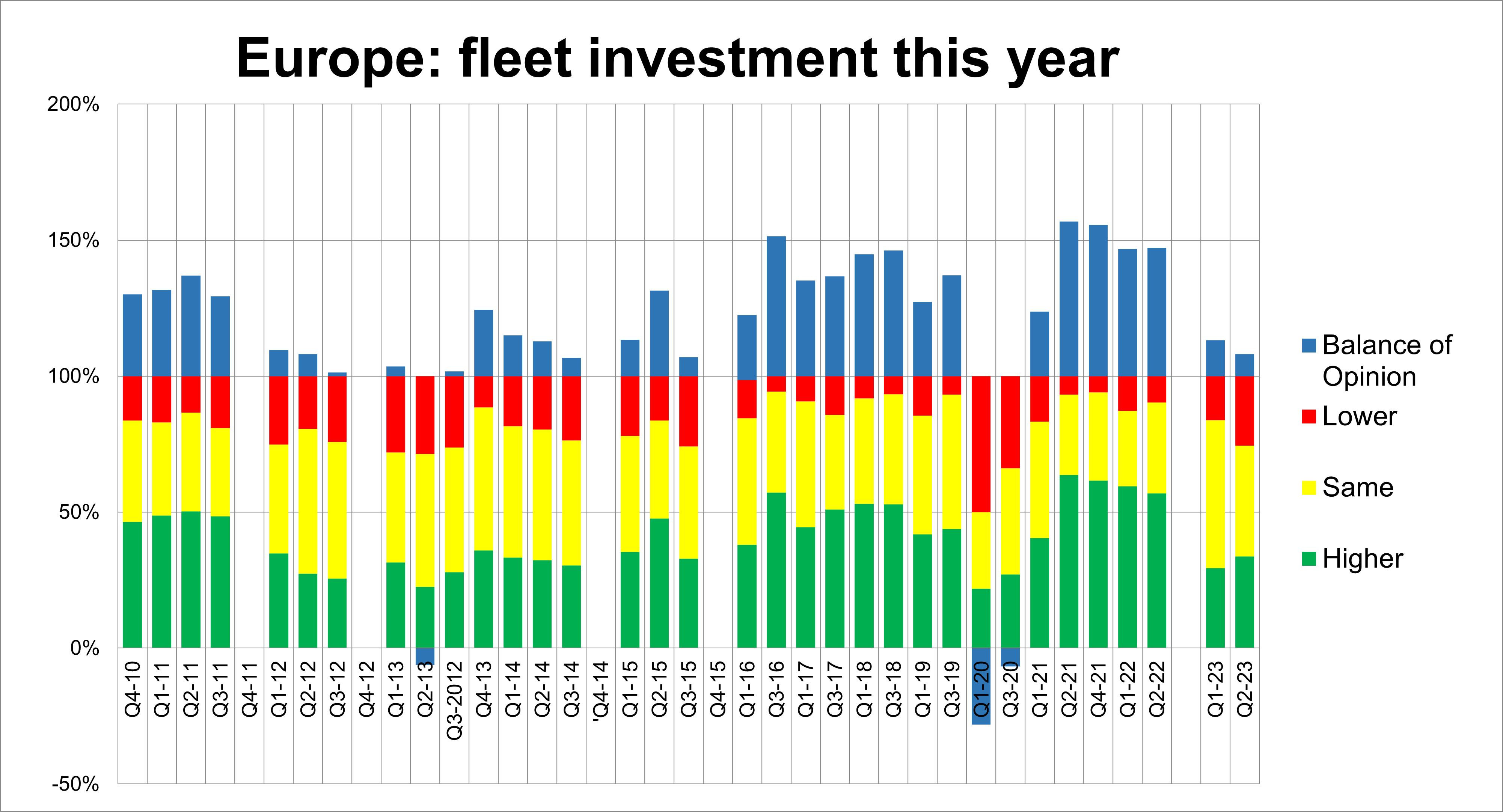

The responses on fleet investment make interesting reading, because the same questions – spending this year and next – were asked at the end of March. Since then, investment intentions have polarised. Over 33% expect to invest more this year – up from 29% in March – but the proportion expecting to spend less has increased from 16% to 26%. The balance of opinion on spending this year has moderated to +8% compared to +13% in March.

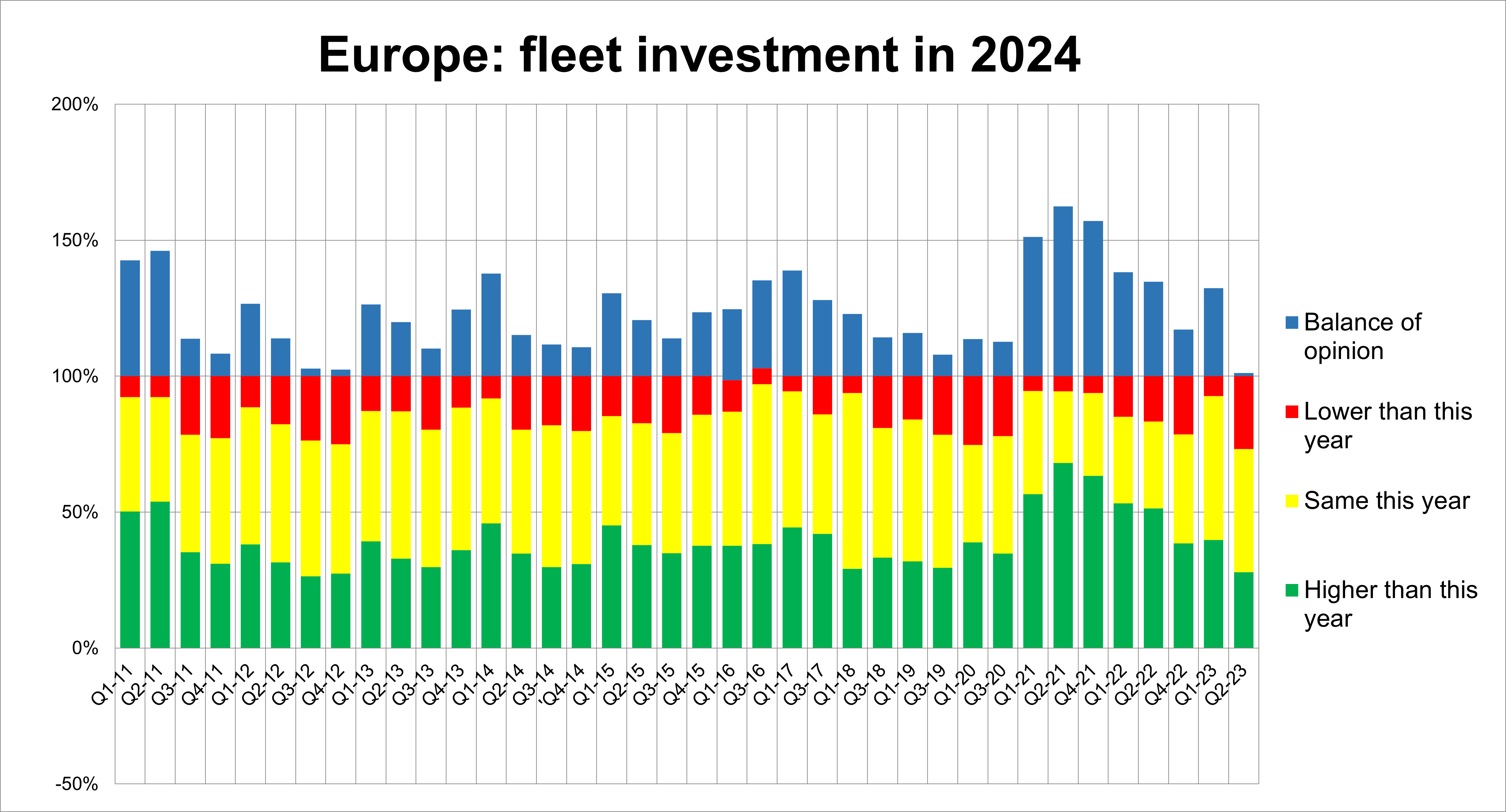

The shift in sentiment is greater for next year. The balance of opinion on spending remains positive at +1% (that is, more people say spending will increase than decrease, although only by a tiny margin). However, more rental companies are saying they are likely to spend less next year (27%) than three months ago, when the figure was just 7%. There was a positive balance of opinion on 2024 spending of 32% in March, so a big change in sentiment over a short period.

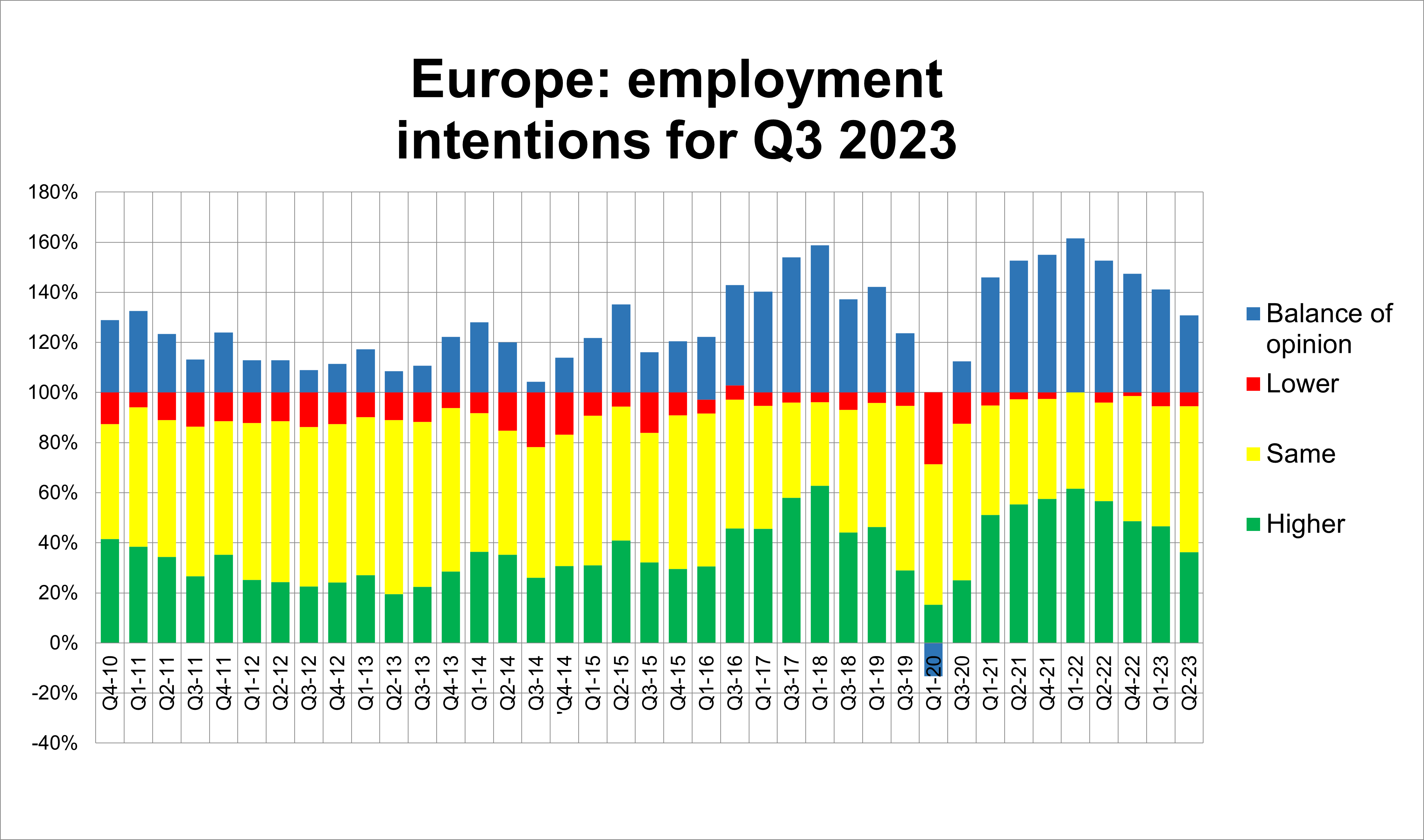

Employment trends

Employment intentions are a complicated matter, because the backdrop is a general shortage of labour in many sectors – which means recruitment efforts are ongoing continually – but combined with a softening of business sentiment. In the case of the RentalTracker, this is manifest by a larger number than usual – 58% – saying that they will not be adding staff in the third quarter of 2023. That compares to 48% at the end of Q1.

The proportion of companies expecting to add staff in the third quarter is still high at 36%, but is still the lowest proportion since the height of the pandemic in 2020.

What can we say about individual countries? France and the UK are at the bottom of most of the metrics, while Spain remains the most positive. It is remarkable, for example, that not a single UK company reported rising utilisation rates in the second quarter of 2023. That compares to 62% of Spanish companies.

It is also UK companies that have hardened their CapEx plans for 2023, with just 13% expecting to spend more this year than in 2022. The same figure at the end of march was 45%.

It is worth adding, to conclude, that a survey like this can sometimes paint an unrealistically bleak picture: a majority of indicators may be going down, but in some cases the fall is small and in others they are falling from relatively high levels.

So, it would be fair to characterise the findings of the Q2 ERA/IRN RentalTracker as a moderating of conditions, with spending and recruitment plans becoming more conservative. There is not a wholesale collapse in confidence.

Note: The survey was conducted in the final week of June 2023 and first week of July 2023, with almost 125 companies in Europe taking part. IRN would like to thank the rental associations in Europe, including ERA, DLR, ASEAMAC and Assodimi, for their help in distributing the survey.