In this edition of the ERA Public Affairs Newsletter, we review the current progress with some of the most important EU initiatives and analyse their potential impact on rental companies. If you have any questions or comments, please get in touch with the ERA team at [email protected].

-

- Data Act

- EU Taxonomy

- Corporate sustainability reporting

- Other initiatives

Data Act

Data Act

In February 2022, the European Commission tabled a proposal for a European Data Act, a regulation to clarify who can use and access industrial and non-personal data in the EU.

The European Commission claims that, with this regulation, data users will have access to the data of their machines and devices and will be able to use it for aftermarket and value-added services, like predictive maintenance. By having more information, data users such as construction companies, will be in a position to take better decisions, such as opting for higher quality or more sustainable products and services. Business and industrial players are expected to have more data available and benefit from a competitive data market. Aftermarket service providers will be able to offer more personalised services and compete on an equal footing with comparable services offered by manufacturers, while data can be combined to develop new digital services as well.

The regulation also provides a new obligation for data holders (such as manufacturers). Product manufacturers will be obliged to share readily available use data free of charge and these access rights cannot be restricted through any agreement or contractual arrangement between the manufacturer and the user. The user in this case means a natural or legal person that owns, rents or leases a product or receives a service, so rental companies or contractors are understood by the regulation as data users.

The data generated includes data recorded intentionally by users and data that is a by-product of user actions, such as diagnostic data, and without any interactions, including when the machine is in standby mode or even switched off.

The proposal also prohibits unfair contractual terms (it will be legally prohibited for OEMs to exploit their stronger market position in relation to smaller parties, such as SMEs). New rules will also allow customers to switch between different cloud data-processing service providers and put in place safeguards against unlawful data transfer.

CECE (the machinery manufacturers´ federation) has adopted its position on the proposal calling for, among other things, separation between B2B and B2C contracts, better definitions, the right for compensation for data holders for the value of the data and the costs for data sharing, and a longer transitional period.

EU member states are expected to agree on a common position on the proposal in December 2022, while it will take the European Parliament a few months more to agree on its position. After inter-institutional talks reach a compromise (possibly still in 2023), there will probably be a 12 month period from the date of the publication for the regulation to be applicable.

EU environmental taxonomy for sustainable activities

EU environmental taxonomy for sustainable activities

EU Taxonomy reporting requirements

The EU Taxonomy is a European classification system for sustainable economic activities that aims to direct investments towards sustainable projects and industries.

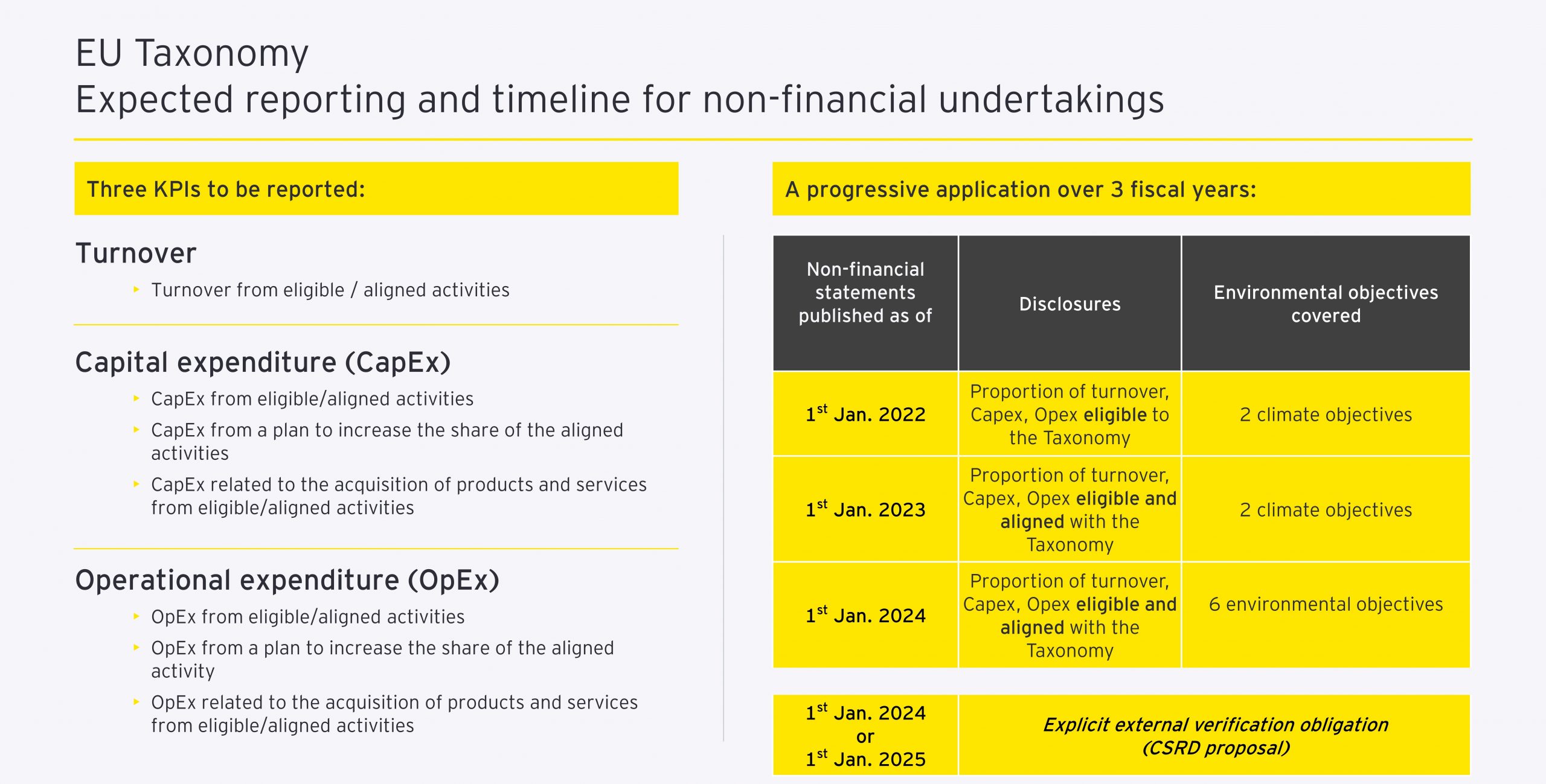

The Taxonomy Regulation, in force since July 2020, requires large companies (more than 500 employees) to report in their annual or sustainability reports how much of their turnover, CapEx and OpEx is Taxonomy aligned.

The reporting obligation has applied to the first two environmental objectives of the EU taxonomy since the beginning of 2022. It will apply to the remaining four objectives from 2024, which include the transition to a circular economy.

The activities and industries that are eligible to be covered is to be specified in a delegated act (secondary EU legislation).

ERA position paper

ERA has developed a position paper to advocate for the broadest possible inclusion of the rental model in the delegated act that relates to the transition to a circular economy.

In the position paper, ERA argues that the rental of all equipment is environmentally beneficial, regardless of the rented product (be it construction machinery, electric-powered equipment or modular containers, etc.). Inclusion of all non-road mobile machinery and other frequently rented items is important for rental companies from an economic point of view, but also in order to maintain equality of treatment between activities in the same sector.

Furthermore, ERA argues that equipment rental activities must be included in the EU Taxonomy without any additional criteria on lifetime and use intensity. The rental model by definition stimulates efficient use of equipment by supporting shared usage, repairability of equipment, optimised resource use, reusability and recyclability. This ensures a substantial contribution of the rental business model to circular use.

Next steps

The inclusion of rental in the EU Taxonomy will be important for investors to keep financing the sector and for the recognition of the industry as a green activity directly contributing to a circular economy.

After some delay already, the European Commission is not expected to table the proposal for the delegated act before summer 2023. However, the rules must be in place before 1 January 2024 when the full Taxonomy reporting requirements will apply.

Download the ERA position paper (available in English and French) on the ERA website.

Corporate Sustainability Reporting

Corporate Sustainability Reporting

Corporate Sustainability Reporting Directive

In November, EU legislators reached a compromise on the proposal for a Corporate Sustainability Reporting Directive (CSRD). The proposal aimed to make sustainability disclosures by European companies more comprehensive and comparable to one another, similar to financial accounting and reporting. The scope of the regulation has been enlarged to cover all large companies (meeting at least two of these criteria: more than 250 employees, a net turnover that exceeds EUR 40 million and assets that exceed EUR 20 million) and all companies listed on EU regulated markets. It is estimated that it will affect approximately 50,000 companies in the EU.

However, the application of the rules will start progressively from 2024 to 2028, depending on the type and size of the company. For EU businesses it means:

-

- For the 11,700 large companies currently reporting under the non-financial reporting directive, the CSRD will apply from January 2024 with the first reports due in 2025.

- For the additional 38,300 large companies that fall under the new criteria noted above, the CSRD will apply from January 2025 with the first reports due in 2026.

- Small and medium sized companies listed on EU regulated markets will be subject to the CSRD from 2026 (first reports due in 2027), although they will be able to opt out during the transitional period until 2028.

- Non-EU businesses with substantial activity in the EU will have to report on their ESG impacts if they have a net global turnover of at least EUR 150 million.

European Sustainability Reporting Standards

In order to compare and benchmark sustainability reports that today vary widely across a multitude of reporting standards and frameworks, the CSRD mandates the establishment of a harmonised standard for ESG reporting – European Sustainability Reporting Standards (ESRS).

ESRS are being developed by EFRAG (European Financial Reporting Advisory Group). The first set of standards were approved in November 2022. These standards outline requirements for detailed corporate reporting on a broad range of environmental, social and governance (ESG) issues.

Companies will have to prepare the information in a digital format that is machine-readable and tagged, so it can be fed into the EU’s single access point. Audited assurance of reported information will be required.

There will be 84 disclosure requirements in 12 different ESG areas. For some disclosure requirements, phase-in periods were also introduced and some more detailed requirements will be moved to future sector-specific standards.

The sector-specific reporting standards will be developed by EFRAG in 2023 and 2024. One of the sectors that will have its own sector-specific standards is machinery and equipment, however the first sectors to be worked on are priority ones like energy and vehicles.

ERA’s CSR KPI framework provides guidance to rental companies on which non-financial performance aspects should be reported on. Rental companies that implement the KPI guidelines contained in this framework will be well placed to respond to the requirements of the CSRD legislation. The KPIs listed in the ERA framework are in line with the requirements of the forthcoming legislation.

Other initiatives

Other initiatives

Several EU initiatives that are relevant for rental companies have recently seen progress in their legislative process:

Corporate Sustainability Due Diligence Directive (CSDDD)

The proposal tabled in February 2022 would require companies (through national legislation) to conduct due diligence on their suppliers and customers, and they could also be liable for how their products are used and disposed of.

The legislative process is ongoing. It has been reported that some EU member states are pushing to reduce the focus of the Directive only to the supply part of the value chain and not to the downstream part. The European Parliament, on the other hand, seems to be divided on the question of whether SMEs should within the scope of the Directive.

According to the Commission proposal, the Directive will apply to EU companies with more than 500 employees generating a EUR 150 million turnover, or with more than 250 employees and a EUR 40 million turnover if operating in the agriculture, mineral and textile sectors. Non-EU companies generating a EUR 150 million turnover or EUR 40 million turnover in the aforementioned sectors are also targeted.

Machinery Regulation

The proposal for a Machinery Products Regulation is well advanced in the trilogue negotiations among the EU institutions and it is expected that these will be concluded in the next few months. The main stumbling block remains Annex 1 to the regulation defining the list of “high risk” machinery for which a mandatory third-party conformity assessment would be required.